First of all, I’m pleased to let you know that the comments notifications via email work again! That is, when you “@” someone or when you click the Follow button on a comment, you will get those emails like the good old days. Please be prepared for a MEGATON OF EMAIL as the servers catch up with a month’s worth. Sorry about the spam, but it has to clear it all out.

I have another bit of good news for you, though: SlopeCharts now has the Pivot Points study.

Pivot Points are a series of five horizontal line segments drawn on the chart to indicate zones of support and resistance. Because these are based on daily data, the line segments themselves span one month at a time. In other words, the pivot points for June are based on May’s daily data, those for May are based on April’s daily data, and so on.

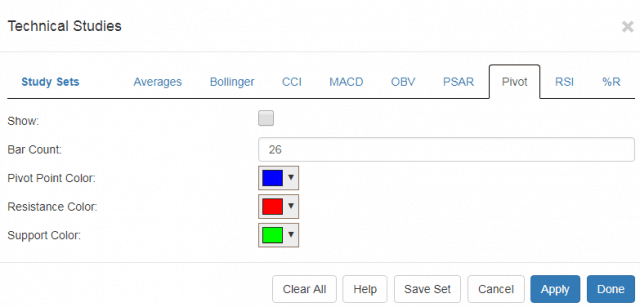

Applying this study is done by clicking the Studies button in the upper right of SlopeCharts and clicking Customize. That brings up the dialog box with all the available studies. Click on Pivot to choose Pivot Points. In that tab you will see the checkbox (to display the study) as well as the dropdowns to change the default colors and the number used for the bar count. You will normally just leave these alone and check the checkbox then click Done.