Some of you have seen this before. Some of you haven’t. I’ve watched it many times. If there was one thing that convinced me that I wanted to live in the world of trading, it was this 1987 documentary on Paul Tudor Jones: The Trader.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

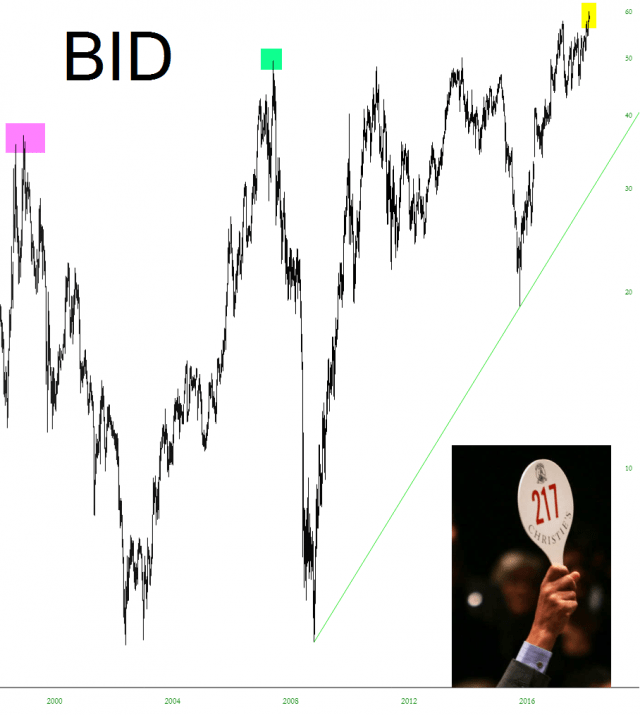

Going………Going……..Gone?

I have written about Sotheby’s many times in the past, because it has the curious role of being basically the company catering specifically to Very Rich People. Let’s face it, folks like you and me aren’t bidding tens (or hundreds) of millions of dollars on pieces of art. In the past, Sotheby’s has been an interesting harbinger of psychological shifts in the market, but I must say, I’m not seeing it here. It just keeps blasting to lifetime highs. All that central bank money has to flow somewhere, I guess……..might as well be a $150 million painting.

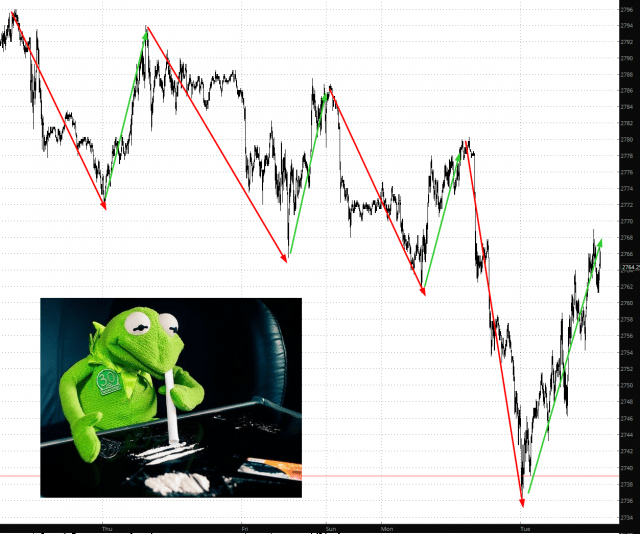

Ripsaw

Well, my tweet last night was spot-on:

If you look long enough, I think you can tease out a pattern to this madness:

SlopeCharts Granularity

A couple of weeks ago, I ran a SlopeCharts survey to find out what people wanted to see in my beloved SlopeCharts product. I was surprised to see that by far the most requested improvement was the availability of chart periods other than daily – – that is, weekly and monthly charts.

Well, they’re ready to use now for everyone! You’ll see this new item up on the SlopeCharts menu bar: