Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Build America Bond Short Doing Nicely

Let Us Never Forget

Shorted Euro

All the bullishness on the web – even on my own blog – makes me want to puke (short term) and smile (long term). People never learn. Ever. This is a bubble. It's a bubble from the government, and it's going to make the Internet bubble and the Housing bubble look like a soap bubble. And people are buying into it like there's no tomorrow.

It's different this time, right? Sure it is.

Anyway, I shorted a large slug of FXE earlier today at 133.17 with a stop at 133.71.

Looking Pretty Strong (by Springheel Jack)

I'm expecting a big move today, and so far at least it looks likely to be a move up. ES and NQ have found some resistance at the 1234.25 and 2211.75 levels respectively and I have some upside targets if those levels are exceeded. If they aren't exceeded then I'm leaning slightly towards seeing a significant drop today as we are still overdue for a retracement, and numerous charts are testing major resistance levels. If we see that drop today then it might be a few days before we see the current highs exceeded. Bull flags are currently forming on the ES & NQ 5min charts and the direction of the breakout from those flags should define the day today.

On ES and NQ I have possible rising channels, though we've not yet seen a retracement to establish a lower trendline on those. The upper trendlines are established however and I'm seeing resistance for ES in the 1245 area today if we get that far:

On NQ with a very well established resistance trendline I'm seeing resistance in the 2222 area today:

The probable ultimate target of this wave 5 move is the ES rising wedge upper trendline that is currently in the 1254 area. I don't think that this move is anywhere close to being finished though, so I'd be surprised to see that hit this week:

I'm watching USD with great interest here. After EURUSD broke declining resistance last Friday I'm very much considering the possibility that the USD uptrend is over. Short term though USD may be basing for a retest of the 80.13 resistance level and we may see some downside for EURUSD and the other USD currency pairs.

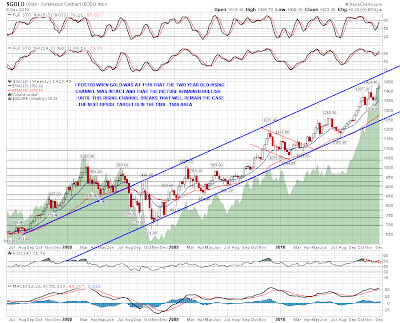

Gold and silver have been having an amazing week and silver is breaking up through the 30.5 level that I'd been expecting to provide decent resistance. I've been looking at the long term gold chart and if gold can also break long term resistance here then I'm expecting to see the next high in the 1480 to 1500 area:

Oil is still in the rising channel that I've been posting for a few weeks and the next channel target is in the 91.4 area. I was wondering about possible resistance at the 90 level as I did the chart below but as that has now broken I'm expecting to see the 91.4 target hit soon. That could well be a significant interim top for oil though I do have another target in the 95 area if 91.4 doesn't hold: