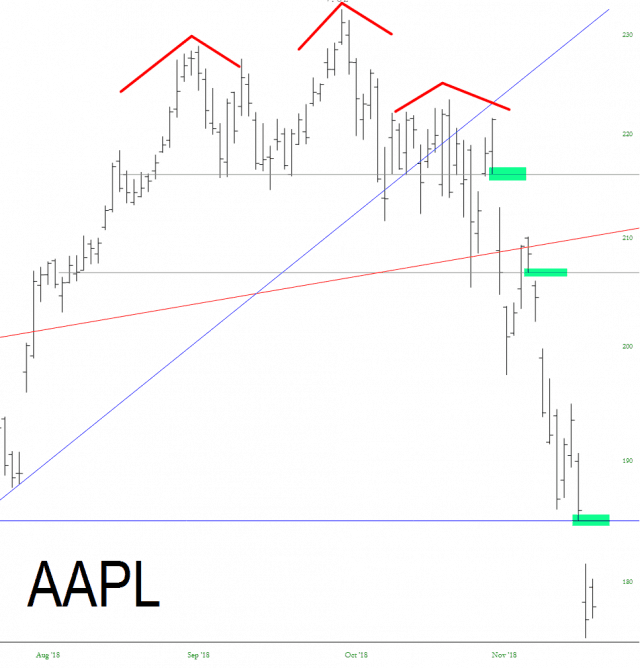

Now that we’re in an honest-to-God bear market………….thank the maker…….I am obsessing over charts even more than I normally do (which is saying a lot). I’ve noticed that the most interesting charts are those which are breaking down in stages. That is, they will be locked into a range-bound period of consolidation, and then some “shock event” will lurch them down to a new, lower range, and they’ll stay locked there. It makes for good use of horizontal lines. Apple is a good example:

Indeed, it makes me think that this bear market could be defined as one with “stages of rages”, instead of the old-fashioned name for a bear market which was……..let me think…….oh, yes: a slope of hope.

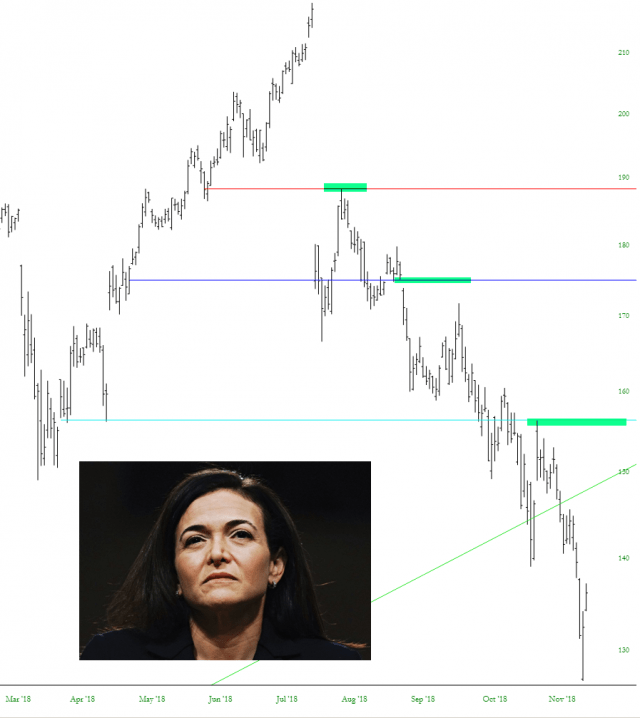

Facebook, adorned here with the glowing smile of Cmdr. Sandberg, likewise has been getting smashed down, range by range, as it has endured a 40% drop in value.

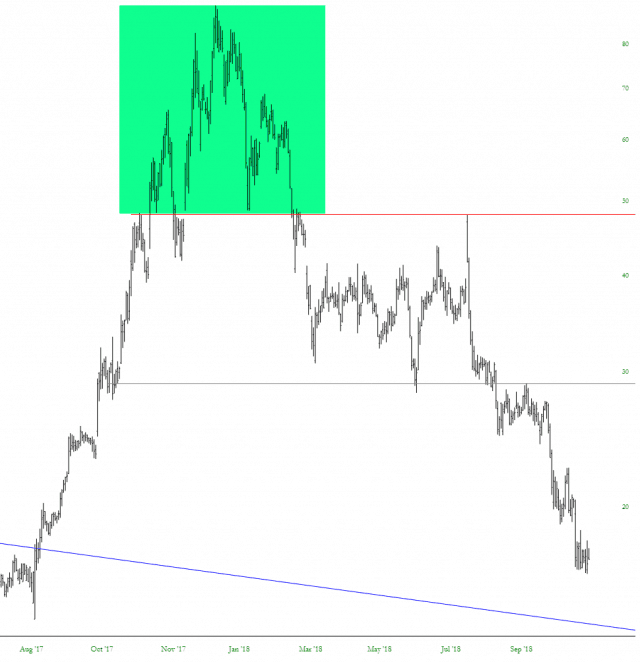

I’d also like to present Overstock as an example. I’ve got it in for this company for many reasons, including (1) their CEO, Patrick Byrne, has had his panties in a wad for years (decades, actually) about short-sellers and (2) they very publicly threw their lot in with the crypto-crowd earlier this year, which briefly propped up their sagging stock price. It, errr, didn’t last.

As for myself, I was most aggressively positioned Tuesday morning (100 shorts), much lighter Wednesday morning (54 shorts) and somewhat more aggressively by end of day Wednesday (71 positions). The annoying thing is that we’re going to have to spend the next 10 days anticipating, and then dealing with, a China “deal” or lack of one.