Alan Greenspan, Benjamin Bernanke, and Janet Yellen must be laughing their wrinkly assess off, now that goy-boy Jerome Powell has been stuck holding the biggest stinking bag in the history of the universe. What a schmuck. And he seems like a pretty decent guy! Shame.

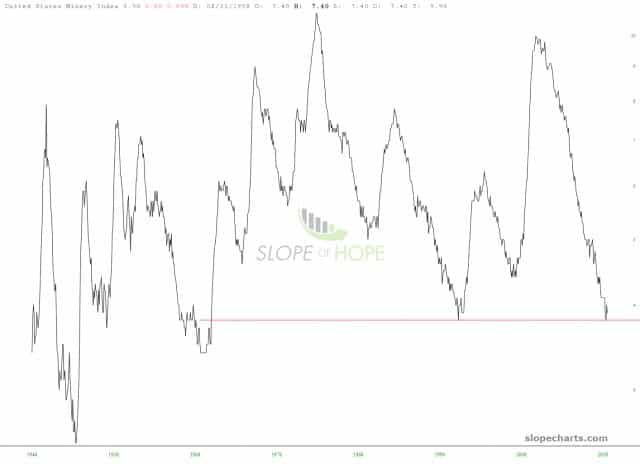

Anyway, in spite of this completely fake, phony, fraudulent bull market of the past nine years, I’m still a believer in the cyclic nature of – – well – – everything – – and while the politicians and media celebrate record lows in the misery index (shown below, thanks to SlopeCharts), it should strike abject terror into the heart of thinking people………..like yourself.

Data like that above tells 99.9% of people that things are great. Jobs everywhere! Prosperity! Low interest rates! Hurray! I mean, look how desperate companies in my town have become for any humans to work their grills! This is from a BBQ joint opening in a couple of weeks near me:

What the misery chart tells me is that there’s nothing but trouble ahead. And the trouble is going to be, oh, I dunno, about fifty times worse than the trouble of the financial crisis, because we’re in such vulnerable shape now. We’ve pissed off the entire world and we’re irretrievably buried in debt. You’re already well-acquainted with the angst and conflict out there, yes? Can you imagine what it’s going to be like in BAD economic times?

And one needn’t wait long to feel the first effects. The interest rate on my house used to be 3.25%. Earlier this year, it went up to 4%. Just yesterday, I opened up the envelope, and my lovely bank with its lovely bailout funds that saved its lovely ass was pleased to report to me the rate was now 5.125%.

Funny how what they charge is going up a lot faster than what they’re paying out, isn’t it?

What this means, of course, is that cash in Tim Knight’s pocket is instead going to Mr. Banker’s pocket, to NO benefit of Tim Knight. It’s a loss to me, and a gain to them. So what’s so great about that? It sucks!

I have some advantages, though:

- By way of a merciful God, the amount left on our mortgage equals about 5% of the home’s value;

- By substantially increasing my monthly payment, I’m going to chop a decade off the payback period.

In other words, I can tell the banker to take his 5.125% rate and shove it earlier than anticipated, because I have enough extra cash to make that choice. Who knows, if rates keep cranking higher, maybe I’ll just pay the damned thing off and be done with it. Eat me, Mr. Banker.

But most people aren’t in that position. Can you imagine the poor sons-of-bitches who paid top dollar for a house here, including an annual property tax bill of $80,000, and are not only seeing the value of their asset decline, but also get to pay more each month for the privilege? The Chinese all-cash buyers left two years ago, people! Here are home prices in my neighborhood (symbol: $PALO):

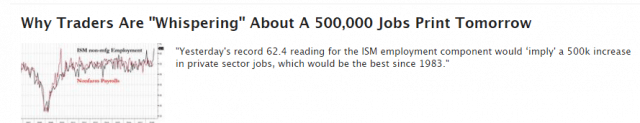

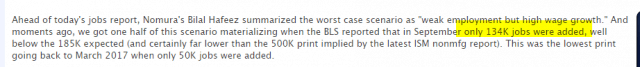

Anyway, as usual, all the speculative chatter about the jobs report turned out to be useless. Because just yesterday:

Well, they’re not “whispering” about that anywhere, as the actual number is, oh, about 1/4th that amount.

Anyway, here’s hoping for a good day today. Jerome Powell’s pain is my pleasure, so I’m grateful to him. Let’s roll.