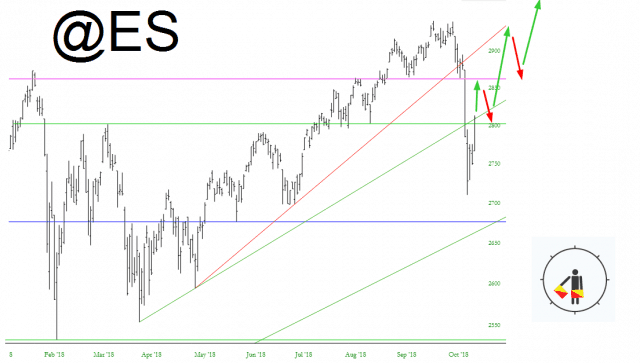

Apparently everyone “knows” that the drop we saw in the first two weeks of October is going to be a repeat of what happened earlier this year on February 9th. I’d like to think of some broader possibilities. There are, of course, practically limitless possibilities for what the market will do next, but let’s consider four distinct general pathways. (Incidentally, it occurs to me that all of these are the S&P cash index, not the @ES, but I’m not about to relabel all of them!)

The first possibility is, again, what everyone “knows” will happen. That, for the 397th time, the stupid bears will be sucker-punched, and new lifetime highs are just a few weeks away. We’ll call this prospect “Alpha“: