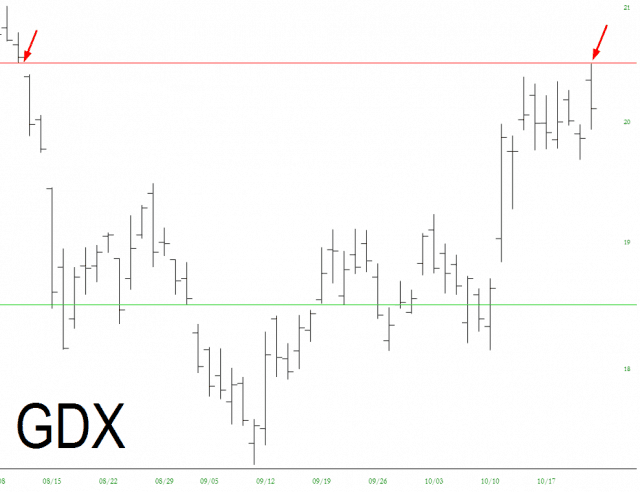

Excerpted from the Market Internals segment of this week’s Notes From the Rabbit Hole, NFTRH 522 (Oct. 21). The segment focused on the bond market and its macro signaling this week. There was more to the segment, including US and global negative divergences in play to long-term yields (positive divergences for bonds) despite the bullish technical situation, and some possible implications/downside targets for the stock market.

Treasury Bonds and the Fed

The technical signs [of a potential bond bear market/breakout in yields] are there, but…