Editor’s Note: Welp, Mr. 3225 on the S&P is back. Interesting now that this price target is still offered, although now it may be “years away.’ Read on:

It seems the pundits have lost their way. The reasons for the market moves have now confounded most market participants and pundits to such an extent, and they are stretching so far to provide a reason for a market move, that we have moved from the ridiculous to the sublime.

In the last several years I have outlined how the market has completely ignored the dozens of negative geopolitical events that were supposed to have adversely affected our market as it has continued to rally towards our long-term targets.

So, do any of you ever realize how ridiculous many of these news reports sound when they try to link the market action to the news? As I have said, there is almost always some positive news of the day to which the media can relate positive market action, and vice versa. But when there is no news to which they can easily relate the market action, it highlights how silly it really is to relate the news to the market action.

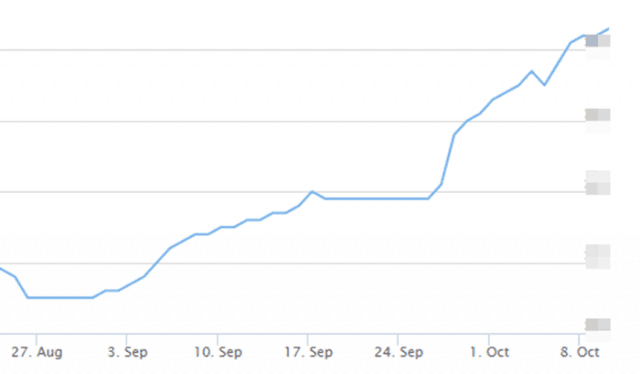

In fact, the market action we have seen at times almost mocks those who believe that negative events will cause negative reactions in the stock market. The other week, we saw announcements regarding another $200 billion in trade tariffs. And what did the market do? Yup, it immediately rallied over 50 points. Please take a look at my attached chart, which highlights how we rallied 9% since the start of the trade wars: