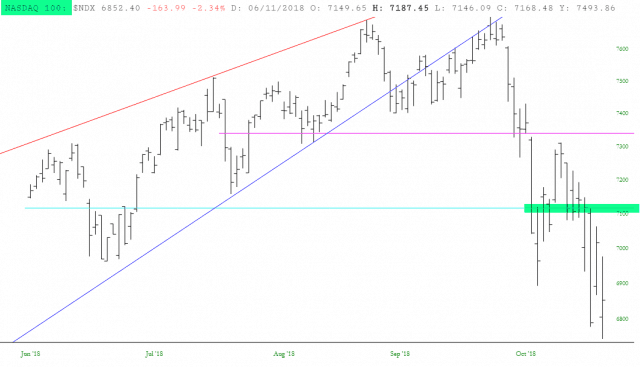

I’ve been describing this as a “stock picker’s” market recently. Allow me to show a very specific example. Or, should I say, ten examples.

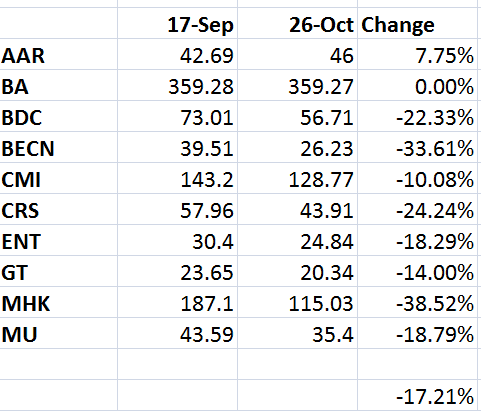

Back on September 15th, I did a premium-only post called Sector Focus: Manufacturers. I have changed the post so that everyone can see it now. I had ten specific short ideas. One of them – ARRS (its symbol changed to AIR, apparently) went up a little, so that was a loser. But most of them did great, including one, MHK, which was down almost 40%. Keep in mind, this is in just over a month.

Overall, the drop was 17.21% even with the dud, which is over TWICE as big a drop as the S&P 500. So……….that’s what I’m talkin’ about!