I recognize all too well the hazards of making any market commentary at nighttime. I am typing this on Monday evening, alone in my home with the exception of all my animals, and the ES and NQ are down nicely, both double digits. However, we had precisely the same situation Sunday evening, and thanks to the Chinese National Team (part of the global cabal that’s created this completely FAKE bull market since 2009), it was Green Green Green by Monday morning. (I still made plenty of money on my shorts Monday, so, screw you, Chinese bureaucratic scumbags).

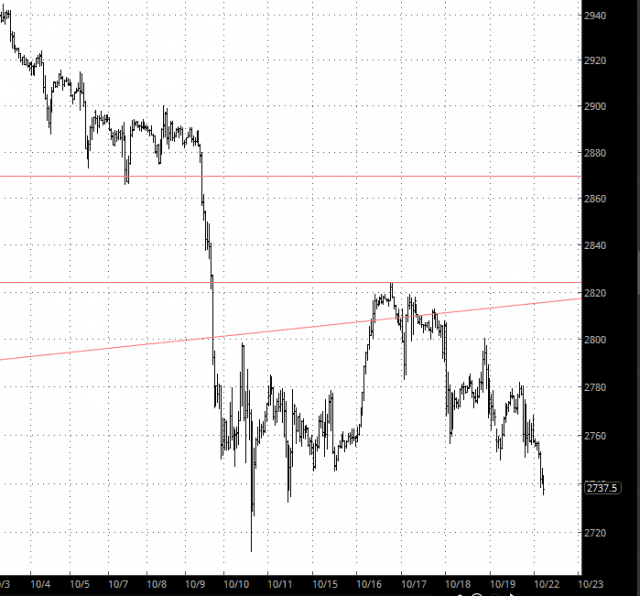

Anyway, it’s best not to get too excited about the GLOBEX markets. I would, however, like to say one thing about what we’ve experienced during this absolutely marvelous month: